Ghost Kitchens:

Emerging Opportunities and Increasing Convergence

with Traditional Hospitality

Akshara Walia

Director of Research

PKF hospitality group

January 2023

Ghost kitchens – also known as virtual, dark or cloud kitchens – have generated significant interest in recent years as a source of innovation and disruption in the food & beverage (F&B) sector. With an exclusive focus on delivery, these establishments eschew the traditional front of the house – storefront, dining space, furniture and fixtures, wait staff, etc – and cater to customers rather via an online platform; usually a third-party delivery app.

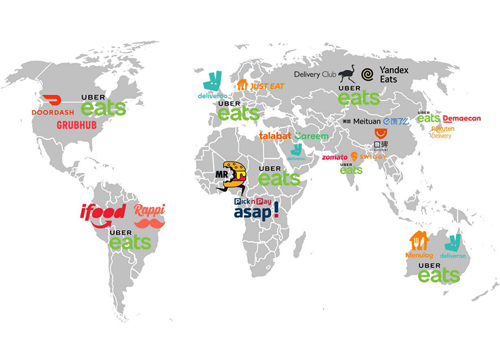

The delivery-only model largely emerged as an emergency response to the closures and lockdowns imposed in the wake of the COVID Pandemic. Restrictions on mobility resulted in an exponential growth in online food delivery with traditional brick-and-mortar dining spaces migrating their operations to online platforms like Uber Eats, Doordash and Deliveroo. However, while enforced isolationism may have been an inadvertent driving factor, sustained growth for the sector is still foreseen as restrictions ease and operations return to normal. The online food delivery space was estimated at $150 billion in 2021, having tripled since 2017. Increasing digitisation and the rising number of smartphones worldwide, coupled with ease of application, growing tech-reliance and the convenience driven lifestyle of millennials and Gen Z, are expected to sustain the online F&B space and drive growth for the foreseeable future.

Fig 1: Global Proliferation of Online Food Delivery Platforms

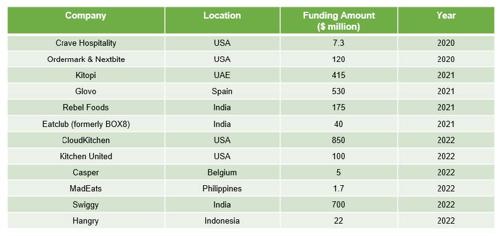

Potential for ghost kitchens is thus evidenced in the rapid expansion of online delivery, with boundless opportunities for growth, diversification and innovative collaboration. Industry estimates peg the current market size at around $43 billion, with sizable investments and expansions planned in the near future. Kitchen United – ghost kitchen pioneer with around 200 kitchens operating across twenty regional markets in the United States – welcomed new investors like Kroger, Restaurant Brands International and the HAVI group via a $100 million Series C fundraising venture. Their multi-restaurant virtual food hall concept, Kitchen United MIX, is also expected to expand in collaboration with US retail giant Kroger, enabling customers to place food orders via digital kiosks or a mobile app while shopping. Digital restaurant provider C3 (currently operates around 40 virtual restaurant brands and 250 ghost kitchens in the US) received $80 million in Series B funding (Brookfield Asset Management and REEF Technology were among prominent investors) to expand their footprint across brick-and-mortar establishments, food halls and dark kitchens. This was preceded by initial investments from Simon Real Estate and Accor Hotels. In the Latin American markets, cloud kitchen start-up Muncher secured $27 million in funding, intending to expand their footprint across Colombia, Mexico, Peru and Brazil. However, the largest investment venture in recent years was undoubtedly the sizable $850 million raised by leading dark kitchen provider CloudKitchens, with Microsoft emerging as a prominent investor and backer. Thus, the market continues to expand globally – Growth Kitchens in London, MadEats in Manila, Casper in Ghent, Rebel Foods in India, etc – as more and more start-ups explore the opportunities presented by dark kitchens.

Fig 2: Prominent Fundraising Efforts for Ghost Kitchen Start-Ups

(Note: List is not exhaustive)

Thus, it should come as no surprise that industry estimates project a market size of $71 billion by 2027 for ghost kitchens and associated industries.

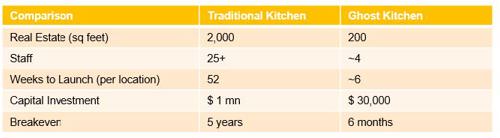

Aside from obvious advantages like flexibility in operations and access to a large online customer base, ghost kitchens also mitigate some significant encumbrances of the traditional operating model. Notably, they minimise overhead costs and large-scale investments in the front of the house – dining spaces, furniture, wait staff, etc. Moreover, since they are not reliant on walk-in customer traffic, they can leverage on cheaper rentals in less sought-after locations like industrial and residential spaces. The flexibility of operating in an online domain also enables ghost kitchens to diversify, operate multiple brands out of the same space and expand product offerings. The efficiency and adaptability afforded by this operating model allow for consistent product optimisation and faster course correction without incurring prohibitive costs.

Fig 3: Side-by-side Comparison of Start-up and Operating Costs, Traditional vs. Ghost Kitchen

(Source: Estimates from CloudKitchens)

However, one key advantage of ghost kitchens – i.e. the leveraging of underutilised spaces in unconventional locations – has resulted in some unlikely pairings. As hospitality and allied sectors struggle to recover in the aftermath of the pandemic, increasing cooperation and integration with ghost kitchens is expected. Hotels grappling with low occupancy rates, for instance, do not require a full-service restaurant with dining space and may find leasing kitchen spaces to a ghost kitchen provider far more cost-effective. The hotels benefit from this F&B outsourcing which caters to guests via room service, may offer multiple menus (depending on how many brands are operating from the dedicated kitchen), provides a consistent rental income and cancels the cost of directly operating a restaurant on the hotel premises. The restaurant in turn, benefits from a fully equipped kitchen, comparatively lower start-up costs and a wider customer base from both hotel guests and external delivery orders.

The advantages of such a cooperation are being recognised by the wider market, with unlikely pairings of hotels and ghost kitchens becoming increasingly visible. Ghost kitchen provider C3 announced their partnership with Graduate Hotels to launch ‘Graduate Food Hall’ – a hybrid digital kitchen concept featuring dine-in options at hotels as well as delivery and takeaway options. In the Sandton district of Johannesburg, South Africa, Hyatt House is collaborating with dark kitchen ‘Gimba’ while a second dark kitchen ‘Dhaba’ operates out of their Rosebank property. Both operators are also present on Uber Eats, offering deliveries in the aforementioned districts. Additionally, The Hilton Garden Inn and Suites in Sacramento, California hosts ‘Another Wing’ — a collab venture between REEF Technology and celebrity music artist, DJ Khaled.

Such cases are not limited to hotels. In theory, any large scale commercial area with a dedicated kitchen space – shopping malls, universities, hospitals – could host a ghost kitchen operation. Kitchen United partnered with Simon Property Group to launch their ‘Grab Go Eat’ platform in shopping malls, enabling customers to place orders at multiple restaurants for dining, pick up or delivery. The company also partnered with West Field Valley Fair – the largest retail destination in Northern California – to set up infrastructure for their tech platform MIX and facilitate orders for pick-up or delivery. Other unconventional locations like universities and airports have also hosted dark kitchens. During the pandemic, food service provider Chartwell Higher Education facilitated the establishment of ghost kitchens across select colleges in the US including Seattle University, Buffalo State College, University of Utah, University of Texas at Dallas and San Jose State University. Moreover, the ‘Get Reef Virtual Food Hall’ was launched at Raleigh-Durham International Airport in North Carolina, offering selections from nine different restaurants.

These cases illustrate the scope and potential of dark kitchens as revenue generators and a value-driven addition to large-scale real estate. They represent an adaptive and flexible approach towards F&B, focused on minimising start-up costs, leveraging underused space and assets, and diversifying existing product lines to serve niche customer interests. A further point of interest originates from their tech-centric, data-driven and analytics based approach where big data pertaining to trends, orders, menu performance, customer demographics and location is analysed for diversifying offerings, optimising products, fine-tuning the menu and scouting new target markets. Collaborators and investors should therefore consider the pivotal role of big data and predictive analytics in establishing a successful dark kitchen.

The emergence of the Metaverse is another consideration which may significantly impact the operational landscape for dark kitchens. A virtual F&B environment augmented by social media and blockchain transactions could, in the near future, host online ‘food halls’ and ‘restaurants’ where users may interact via personalised avatars, place orders and transfer payments from a digital wallet. These enhancements could open a host of possibilities for ghost kitchens from promotional tie-ins and branding, creative partnerships, cost saving by streamlining physical infrastructure and offloading non-essential functionality to virtual business centres, maximising customer convenience and establishing quicker turnaround time.

Nonetheless, caution is advised in the wake of recent concerns. Despite ongoing enthusiasm for the concept and its inherent efficiency, ghost kitchens are still a relatively nascent format. Concerns have been raised regarding existing food quality and safety regulations, as well as the operating practices of certain market leaders which have allegedly resulted in mass lay-offs and abrupt closures. The abrupt dissolution of leading ghost kitchen company Butler Hospitality in 2022 underscores the need for prudence in this space. Furthermore, a post-pandemic ‘return to normal’ also indicates a change in the operating environment. Ghost kitchens must be prepared for a more connected and less isolated world and find ways to adapt the social and experiential factor of traditional dining to their virtual establishments.