What the new sustainability standards IFRS S1 and IFRS S2 mean for companies

Lauren Haslam

Senior Manager in

Transaction Services

PKF Littlejohn

October 2023

The International Sustainability Standards Board (ISSB) issued its inaugural standards — IFRS S1 and IFRS S2 — on 26 June. What should you do to prepare and how do they interact with other frameworks?

The launch marks the start of an exciting new era for sustainability-related financial disclosures. The standards will help to improve trust and confidence in company disclosures. This in turn should support capital market allocations towards more resilient economic models for companies.

The ISSB’s main objective is to provide investors globally with more consistent, complete, comparable and verifiable sustainability-related financial information. The new requirements should also help companies reduce the risk of greenwashing.

It was investor demand for a common language across sustainability reporting worldwide that drove the creation of the new standards. They wanted to be able to compare portfolios more easily. A key consideration for investors is long term value creation, in which sustainability plays an increasingly vital role.

IFRS S1 and S2 used concepts and recommendations from a number of existing frameworks, to set the global baseline for sustainability-related disclosure. This can only be good news for companies. The new global baseline is intended to reduce the so-called ‘alphabet soup’ of reporting that companies face today, particularly those that span many jurisdictions.

The two standards cover general sustainability-related disclosures (S1) and climate-related disclosures (S2). Although it is up to each jurisdiction to adopt these standards, they are effective for reporting periods starting on or after 1 January 2024. This means, in jurisdictions where the standards are adopted, companies will make their first disclosures in 2025.

What do the two standards require?

S1 sets the scene asking for disclosures on all material sustainability-related risks and opportunities that could affect a company’s prospects (cash flow, cost of capital and access to finance).

What are its key concepts?

Materiality Information is material where its disclosure is so important that by omitting, misstating, or obscuring it, it could reasonably be expected to alter the investment decision.

Stakeholder view: Companies need to consider their interactions with stakeholders, society, the economy and the natural environment through their whole value chain.

Industry-specific disclosures: are required. As a source of inspiration, there are examples to help companies understand the kind of information they should provide related to their industry and S1 refers users to the subset of Environmental, Social, and Governance (SASB) standards. The SASB standards, under stewardship of the ISSB, enable organisations to provide industry-based disclosures about sustainability-related risks and opportunities.

The standard requires companies to report under S1 as part of their general reporting package, and emphasises the need for consistency and connectivity with financial reporting. There should be uniformity of assumptions for accounting, where relevant, between sustainability reporting and financial statements.

S2 sets out the disclosures needed for material climate-related physical risks, transition risks and opportunities.

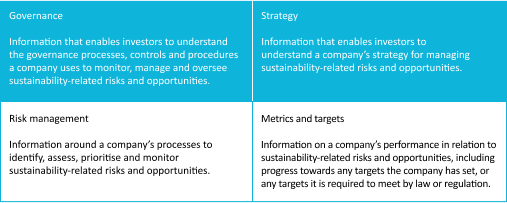

S2 is built on the same four pillars as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. Here are the key points relating to each:

Global implementation

The ISSB’s goal is to encourage companies around the world to implement the new standards either through compliance or by voluntary adoption.

On 25 July, IOSCO (the International Organization of Securities Commissions) announced its endorsement of the ISSB standards. In doing so, it called on the 130 IOSCO member jurisdictions, that regulate more than 95% of the world’s financial markets, to consider how they might apply or be informed by the standards. This is clearly a significant step towards a common language for global sustainability reporting.

The UK (and many other countries including Canada, Japan and Singapore) is considering adopting the ISSB standards. In turn, the ISSB is actively discussing global uptake of the new framework with various regulators. The UK Government has shown support for the ISSB and will be establishing a mechanism for UK endorsement and adoption of the standards as part of the Sustainability Disclosure Requirements regime, with a timeline for implementation expected imminently.

Once available for use in the UK, it is the FCA’s intention to update its climate-related disclosure rules to reflect the ISSB standards.

Interaction with other frameworks

Our clients often ask how the various standards overlap, or where they can save time in the reporting process. When adopting the ISSB’s standards, companies will need to consider other requirements based on jurisdiction and size. There may be differences between frameworks, but there will also be vast overlaps which should reduce the reporting burden and facilitate far more useful information for key stakeholders.

In creating these standards, the ISSB has consolidated many existing frameworks including the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (Integrated Reporting Framework and SASB Standards).

The standards build on the existing TCFD framework, with which we are already familiar. Companies will be pleased to know that in adopting S1 and S2, they will already meet the requirements of TCFD, so reducing the reporting ‘alphabet soup’. The ISSB will now be responsible for monitoring the TCFD.

The ISSB also works closely with the Global Reporting Initiative (GRI) in developing these standards. The collaboration aims to ensure compatibility and interconnectedness between the ISSB’s investor-focused sustainability information that meets the needs of the capital markets, and the GRI’s information that serves a broader range of stakeholders. This work will not only lessen reporting requirements for companies but also harmonise sustainability reporting at an international level.

The standards also work well with other accounting frameworks like US GAAP and UK GAAP, so are truly considered to be a global baseline that’s easy to adopt regardless of your existing reporting framework.

Challenges remain

But companies (especially large multinationals operating cross-border) will still face the challenge of navigating overlapping but non-identical disclosure regimes. The EU, for example, has adopted the Corporate Sustainability Reporting Directive requiring in-scope EU-based entities, and non-EU entities operating in the EU, to make extensive sustainability disclosures aligned with the European Sustainability Reporting Standards (ESRS).

It’s expected that the ESRS will apply in a phased manner from January 2024. The ISSB has said it is working closely with EU authorities to align its own and the ESRS’s disclosure requirements to make them as interoperable as possible. Despite this, differences like ‘double materiality’ remain. The ISSB will publish a comparison between ISSB and ESRS following the finalisation of ESRS and, we understand, the ISSB and the EU will also issue guidance on avoiding duplication.

Under the current UK regime, including Streamlined Energy and Carbon Reporting (SECR) and UK climate-related financial disclosures regulation, certain in-scope companies must already include environmental and social information in their annual reports. Requirements vary depending on size, jurisdiction and listed status, but common elements include disclosing greenhouse gas emissions, energy consumption, water usage and waste management. Companies are encouraged to report on social issues including workforce diversity and community engagement.

How to prepare during the remainder of 2023

- Evaluate existing internal systems and processes and identify gaps.

- Consider the sustainability risks and opportunities that most affect your business’ long-term prospects.

- Review ISSB standards and supporting materials as well as the SASB standards, CDSB framework and the TCFD recommendations.

- Research sustainability matters that affect the whole value chain. This is essential in terms of both risks and opportunities, as sustainability matters are by nature complex and systemic.

- Take advantage of the temporary relief from the ISSB’s decision that entities need not disclose their Scope 3 GHG emissions in the first year. Do this by working with your supply chain to identify their Scope 3 emissions in advance of this disclosure becoming compulsory.

- Upskill your personnel and link your sustainability and finance functions (if they are currently separate).

- Phase in capacity and skill sets to meet these new requirements.

For more guidance on any issues raised in this article, please contact Lauren Haslam.

Lauren Haslam

Senior Manager in Transaction Services

PKF Littlejohn

E: lhaslam@pkf-l.com

M: +44 (0)20 7516 2259