Why serviced living is here to stay

By Tobias Siegel

Compared to traditional hotels, serviced living concepts (especially Serviced Apartments and Co-Living) performed generally better during the global pandemic with a higher occupancy of about 20-30 % in some cases. This was mainly due to the opportunity for social distancing (limited housekeeping service, limited food & beverage offers. etc), self-catering facilities (kitchenette or kitchen in the units), and the overall residential character. In other words, serviced living concepts provide a home away from home. Additionally, more and more serviced living concepts for both short- and long-stayers under one roof are popping up. The flexibility allows these concepts to have a stable basis (long stayers) and to fill up the units with transient guests (often starting from one night). But how future oriented are serviced living concepts? Let’s have a look at some trends that show a positive outlook for the serviced living world:

Flexible lifestyle especially amongst millennials

More and more products that target both students and young professionals (often with a minimum stay of six months) in Co-Living concepts represent good alternatives to traditional flats. Besides students, the target group consists of people staying temporarily in a city for projects, people who just moved to a new city and need a temporary living solution and people preferring to have a flexible lifestyle with some hotel elements and features (e.g. reception, gym, co-working area). The fully furnished Micro Apartments with all-inclusive rents provide a convenient and economical solution for tenants (also considering that in these cases no brokerage commission is involved when looking for a place to live). The current average length of stay is usually between twelve to eighteen months.

picture © to ISTOCK/PEOPLEIMAGES; Mental Floss

Increasing number of single households

Social trends such as an increasing loneliness also contribute to new serviced living models, especially in Senior and Assisted Living. According to Eurofund, one third of all households in Europe are single households. Among people at the retirement age, the percentage of women (42 %) living alone is almost double the percentage of men (24 %) in the same situation [1]. Besides the risk of experiencing financial problems, the physical health of people feeling lonely can also be affected. According to research, loneliness can impact the physical health to the same extent as smoking 15 cigarettes per day [2]. Modern Co-Living or Senior and Assisted Living concepts with attractive public spaces (shared living rooms, terraces, gaming areas, libraries etc.) will therefore serve a big niche market in the long-term.

picture © to Leren Lu/Getty Images; npr

Location flexibility through remote working models

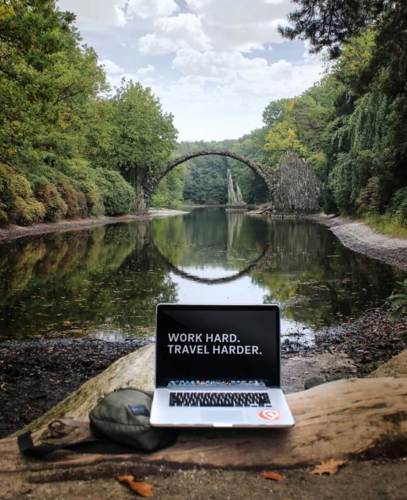

While before the pandemic about 5 % of the workforce in Europe regularly worked from home, the percentage more than doubled to about 12.5 % with the outbreak of the pandemic according to the World Economic Forum. With about 25.1 % working from home regularly, Finland shows the highest percentage of home office workers in Europe [3]. Presumably, most employees will soon return to offices mainly for the social aspect however we expect a remaining demand for flexibility amongst employees (e.g. two to three days per week working remotely or from home). The gained flexibility will allow employees to go on so-called bleisure or workcation trips (combining work with vacation) e.g. for extended weekends. Aparthotels or Serviced Apartments are considered adequate concepts for this evolving guest segment as guests have enough space to work in the apartments and they can live as if they were at home in fully furnished units including kitchenettes.

picture © to Sustainable Lead

Urbanisation and lack of affordable housing in big cities

According to the World Bank, about 55 % of the world population is living in cities. By 2050, seven out of ten people are expected to live in urban areas. Although rural living is also on the rise (due to more affordable housing combined with remote working options), urbanisation will continue playing a major role in the upcoming years. In Europe, the urbanisation rate is currently about 75 % and expected to reach about 83.7 % by 2050 [4]. This development will continue to have a heavy impact on the real estate market and affordable housing demand in big cities. Around 82 out of 220 million European households spend more than 40 % of their disposable income on housing [4]. The lack of investment in affordable housing in Europe is expected to amount to € 57 billion per year [4]. Combined with a record high waiting list for social housing, the continuously increasing demand will lead to more challenges in the future. At PKF livingexperts we therefore consider serviced living concepts such as Serviced Apartments, Co-Living, Micro Apartments, Senior and Assisted Living as long term solutions helping to relieve the real estate market.

picture © to Unsplash

Besides the multitude of current developments (currently there are about 23.500 additional beds from European Co-Living key players in the planning stage [5]), it will be interesting to see more concepts develop within the serviced living world and the ongoing merge between residential and hospitality elements. PKF livingexperts is keen to follow these trends and to be a key strategic partner in the evolution of this exciting segment of the market.

Sources:

1) Eurofund, 2020

2) Harvard Magazine, Jan-Feb 2021

3) World Economic Forum, May 2021

4) European Commission

5) Co-Living Insights No. 1

Consultant

PKF hospitality group

E: tobias.siegel@pkfhospitality.com

M: +43 664 60969132